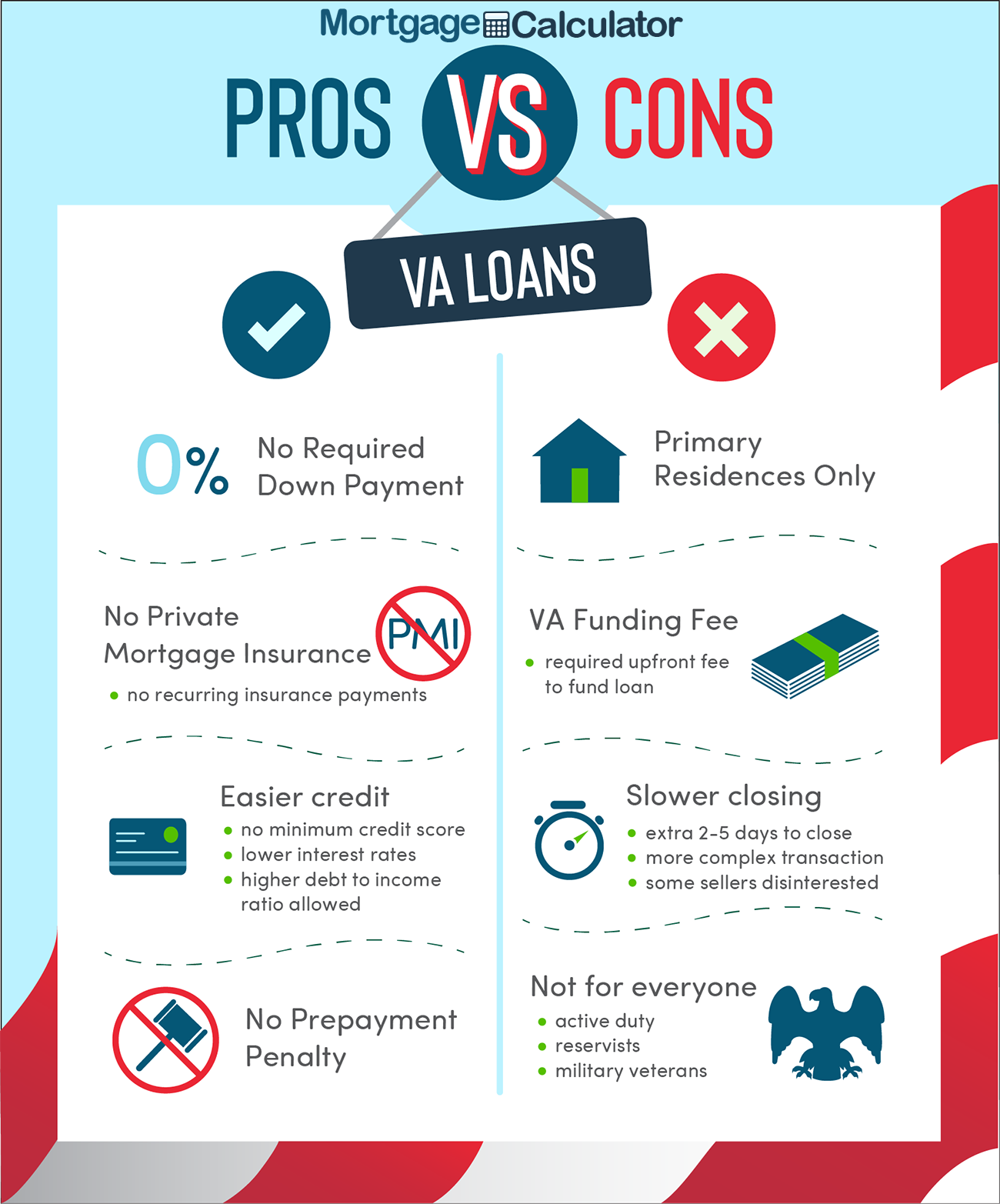

Are you a veteran, active-duty member, or surviving spouse looking to purchase your dream home? If so, you may be eligible for a VA home loan, which offers a range of benefits, including no down payment, low interest rates, and no private mortgage insurance. However, to qualify for a VA home loan, you must meet certain property requirements. This can be a daunting task for many, but fear not! With the right guidance and knowledge, you can maximize your benefits and secure your dream home. In this article, we will discuss the VA home loan program, its property requirements, and how to meet them. From understanding minimum property requirements to working with a VA-approved appraiser, we’ve got you covered. So, let’s dive in and learn how to make the most of your VA home loan benefits!

Understanding VA Home Loan Property Requirements

Before we dive into how to meet VA home loan property requirements, let’s first understand what they are. VA property requirements ensure that the home you’re purchasing is safe, structurally sound, and meets the minimum standards set by the VA. Some of these requirements include:

- The home must be your primary residence

- The home must be move-in ready and free from any safety hazards

- The home must have adequate living space and meet local zoning requirements

- The property must be appraised by a VA-approved appraiser

- The property must meet minimum property requirements set by the VA

Understanding these requirements is crucial to ensuring a smooth home buying process. But how do you ensure that the property you’re interested in meets these requirements?

Benefits of Meeting VA Home Loan Property Requirements

Meeting VA home loan property requirements comes with several benefits. First and foremost, it ensures that the home you’re purchasing is safe and structurally sound. This provides peace of mind knowing that your investment is secure. Additionally, meeting VA property requirements can help you secure a better interest rate on your VA home loan. Lenders are more likely to offer lower interest rates on homes that meet VA property requirements, which can save you thousands of dollars over the life of your loan. Finally, meeting VA property requirements can help you avoid costly repairs down the line. By ensuring that the property meets VA standards, you can avoid any unexpected expenses that may arise from a home that doesn’t meet these requirements.

Tips for Finding VA Loan Eligible Properties

Now that you understand the importance of meeting VA property requirements, let’s discuss how to find VA loan eligible properties. The first step is to work with a VA-approved real estate agent. These agents have experience working with VA homebuyers and can help you find properties that meet VA property requirements. Additionally, you can search for VA-approved properties online. The VA has a list of properties that have been approved for VA financing, which can be a helpful resource in your home search. Finally, you can also ask your lender for recommendations on properties that meet VA property requirements.

How to Ensure Your Dream Home Meets VA Home Loan Property Requirements

Once you’ve found a property that you’re interested in, it’s important to ensure that it meets VA home loan property requirements. The first step is to review the VA’s Minimum Property Requirements (MPRs). These requirements ensure that the property meets basic safety, sanitation, and structural standards. Some common MPRs include:

- The roof must be in good condition and free from leaks

- The home must have adequate heating and cooling systems

- The home must have a functional electrical and plumbing system

- The home must have safe and potable water

While these are just a few examples, it’s important to review the complete list of MPRs to ensure that the property you’re interested in meets these requirements.

Common Property Requirement Issues and How to Address Them

While VA property requirements are designed to ensure that the home, you’re purchasing is safe and structurally sound, there are some common issues that may arise during the home buying process. One common issue is the presence of lead-based paint. If the home was built prior to 1978, it may contain lead-based paint, which can be hazardous to your health. If this is the case, the seller must take the necessary steps to remove the lead-based paint before the sale can be finalized. Another common issue is the presence of mold. If the home has a mold problem, it must be addressed before the sale can be finalized. It’s important to work with a VA-approved real estate agent who can help you navigate any issues that may arise during the home buying process.

VA Home Loan Property Inspection Process

Once you’ve found a property that meets VA property requirements, the next step is to schedule a property inspection. The property inspection is conducted by a VA-approved inspector and ensures that the property meets VA standards. During the inspection, the inspector will review the property’s heating and cooling systems, electrical and plumbing systems, and the overall condition of the property. If any issues are found during the inspection, they must be addressed before the sale can be finalized.

VA Home Loan Appraisal Process

In addition to the property inspection, the property must also be appraised by a VA-approved appraiser. The appraisal ensures that the property is worth the amount you’re borrowing. The appraiser will review the property’s condition, location, and other factors to determine its value. If the appraiser determines that the property is worth less than the amount you’re borrowing, you may need to renegotiate the purchase price or come up with additional funds to cover the difference.

Using a VA-Approved Real Estate Agent to Navigate Property Requirements

Navigating VA home loan property requirements can be a daunting task, but with the help of a VA-approved real estate agent, it can be much easier. These agents have experience working with VA homebuyers and can help you navigate the home buying process from start to finish. They can help you find properties that meet VA property requirements, schedule property inspections and appraisals, and ensure that the sale is finalized smoothly.

Conclusion and Final Thoughts

Maximizing your benefits and securing your dream home with a VA home loan is possible, but it requires a thorough understanding of VA property requirements. By working with a VA-approved real estate agent, reviewing the VA’s Minimum Property Requirements, and ensuring that the property meets these requirements, you can secure a safe and structurally sound home. Additionally, meeting VA property requirements can help you secure a better interest rate and avoid costly repairs down the line. So, if you’re a veteran, active-duty member, or surviving spouse, take advantage of the VA home loan program and make your dream home a reality!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link